Mthuli Ncube delivers ZWG 322,6 bln budget after cutting bids by more than half

Business Reporter

FINANCE Minister , Professor Mthuli Ncube ,Thursday delivered a ZWG322,6 billion budget after turning down bids submitted by the government’s departments by more than 50%.

Themed , ‘Building Resilience for Sustained Economic Transformation’, Ncube said the budget seeks to respond to the challenges and opportunities by laying a solid foundation for future sustained and inclusive growth and development.

He said during the 2025 National Budget formulation stage, MDAs submitted total bids of over ZiG$700 billion, against the available budget envelope of ZiG276.4 billion which was more than double the ceiling of revenue collection capacity of 19.6% of GDP.

The National Budget blueprint allocated fewer resources to security related Ministries in a development which saw the Office of The President and Cabinet receiving US$293,2 million, Defence US$500,9 million, Home Affairs and Cultural Heritage US$449 million.

In comparison , the Welfare related Ministries like the Health and Child Care Ministry received US$785,9 million, Primary and Secondary Education US$1,3 billion, Higher and Tertiary Education US$286,5 million and the Public Service US$297,2 million.

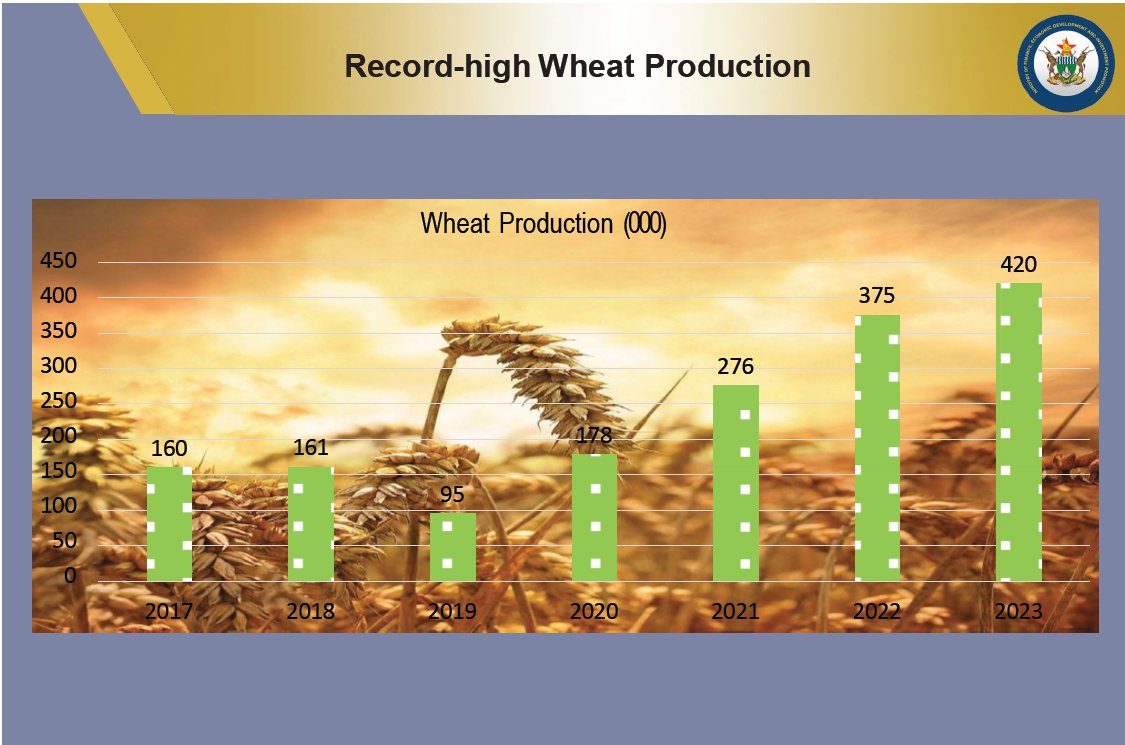

He projected an economic rebound in the year to come on the back of recovery in the agricultural sector.

“In line with the projected GDP growth of 6%, during 2025, revenue collections are estimated at ZiG270.3 billion (19.6% of GDP), comprising of ZiG218.2 billion tax revenues and ZiG52.1 billion non-tax revenues. This takes into account the existing tax policy regime, supported by enhanced revenue administration measures to reduce leakages, as well as additional measures aimed at widening the tax base,” he said.

The Finance Minister provided an update on government finances, revealing revenue collections of ZiG$62.4 billion against expenditures of ZiG$66.5 billion for the first nine months of 2024. Most revenue came from Value Added Tax (VAT) and personal taxes, while corporate tax contributions remained subdued, reflecting the challenges of Zimbabwe’s heavily informalised economy.

Zimbabwe’s total debt burden remains significant, at US$21.1 billion, comprising US$12.3 billion in foreign debt and US$8.7 billion in domestic obligations. The mounting debt continues to strain fiscal stability, posing hurdles to economic recovery.

A New Currency and Economic Stability

Despite the challenges, Ncube highlighted progress made since the introduction of the Zimbabwe Gold (ZiG) currency in April 2024, replacing the Zimbabwe Dollar. The structured currency has contributed to macroeconomic stability and improved economic conditions, laying the groundwork for sustainable growth.

Prospects for 2025

As an agriculture and mining-based economy, Zimbabwe’s prospects for 2025 are bolstered by favourable conditions forecast for the upcoming agricultural season, driven by the La Niña weather phenomenon. Increased investments in critical sectors, alongside favourable international commodity prices, particularly for gold, are expected to enhance export earnings and strengthen the country’s balance of payments position.

Government’s Strategic Focus

Reflecting on the words of Charles Darwin, Ncube said: “It is not the strongest of the species that survives, nor the most intelligent, but the one most adaptable to change.” He emphasised the importance of adaptive production and trade systems in navigating the complexities of the global economy.

The government has committed to prioritising the implementation of tight fiscal and monetary policies to address price pressures and stabilise the domestic currency. Central to this strategy is fiscal consolidation, ensuring the efficient and effective use of scarce fiscal resources.

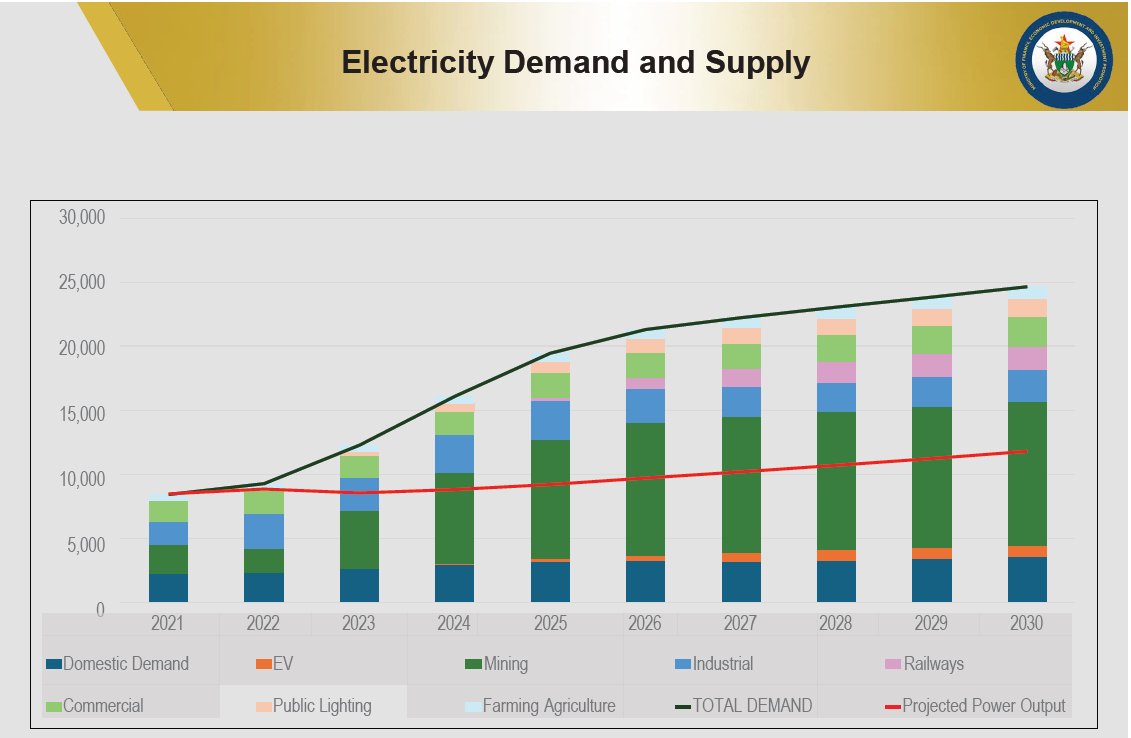

Ncube acknowledged the country’s ongoing electricity supply challenges, which have weighed heavily on economic growth and social progress. To address these issues, the government plans to implement bold reforms, including reducing restrictions on self-generation and encouraging private sector investment to increase domestic electricity production and mitigate power shortages.

Challenges Ahead

Despite the optimistic outlook, observers remain cautious, urging the government to implement structural reforms, diversify revenue streams, and reduce reliance on external borrowing. Inflationary pressures, weak infrastructure, and overdependence on rain-fed agriculture continue to pose risks.

With the macroeconomic environment showing signs of improvement, stakeholders are hopeful that the policies and measures adopted will support Zimbabwe’s path to economic stability and growth. However, sustainable development will depend on the government’s ability to address long-standing structural challenges and foster inclusive economic transformation.